Preparing for the convergence of IoT and automotive

July 14, 2015

How the software-defined car creates opportunities for engineers and benefits for users. The word on the street is that the brave new world of the Int...

How the software-defined car creates opportunities for engineers and benefits for users.

The word on the street is that the brave new world of the Internet of Things (IoT) will significantly impact the automotive industry. It’s a whisper not to be ignored by automotive design engineers, as this represents a whole new way of doing business. With processors and networking seeping into so many parts of today’s vehicles the IoT will overhaul many elements of the auto industry, with areas as surprising as finance (connected vehicles let lenders measure risk) and insurance (networked cars deliver insights into driving patterns and usage rates) being revolutionized by technology. But for engineers, it is in software that the proverbial rubber meets the road.

Traditionally, car manufacturers have not made much of a place for software. Cars have been cost-optimized so they can roll off a dealership’s showroom floor, and then they become the concern of the buyer. While manufacturers might worry about whether warranty issues will arise, today’s software updates are performed almost exclusively by repair shops or the dealer. But looking at vehicles as a platform for future upgrades and customization through software opens up a powerful and lucrative aftermarket for car manufacturers, one that can deliver revenues long after the original sale.

The heart of tomorrow’s opportunities lies in what’s been called the “software-defined car,” a connected vehicle bristling with sensors and processors that rely on software. In this model, graphical displays, touchscreens, computer graphics, and voice control are becoming the car’s interface, with electronic sensors and algorithms determining much of the entire driving experience. The software-driven features coming down the road are amazing: not just new auto infotainment apps, but completely new features like personalization, brand new advanced driver assistance features, extensions for car sharing, regional-specific adaptations, car-to-home integration, new vehicle safety options, remote mobile control, and more.

OTA creates future revenue opportunities

Turning this new vehicular software platform into a potential revenue stream for manufacturers are the over-the-air (OTA) updates that make sure each automobile is running the latest, most effective code. The OTA concept has been speeding forward. At least six automakers – BMW, Hyundai, Ford, Toyota, Mercedes-Benz, and Tesla – now offer OTA software updates, with many more likely to join them over the next 18 months or so.

OTA software upgrades not only affect entertainment systems, but powertrain and vehicle safety systems as well. According to analyst firm Gartner, there will be 250 million connected vehicles on the road by 2020, so within five years OTA software upgrades are expected to be commonplace for new vehicles. The value of the market for connected car services is forecast to grow to $148 billion in 2020, according to PricewaterhouseCoopers (PwC), with safety-related features expected to account for 47 percent of services, followed by autonomous driving at 35 percent, and entertainment features accounting for 13 percent. This networked mobility market represents a tripling from today’s levels, and is not only being pushed by demand for connected-car components, but also by the rise of entirely new digital business opportunities, PwC says.

Designing for the future

The biggest business opportunities arise when engineers design for the expansion of software – for adding new features and functions. Thinking of vehicle functionality after it leaves the showroom will be central to this new thinking, as automobiles (like in the networking industry where areas like buffer, storage, and switching capacity are appropriately designed to enable updates several years in the future) should be built for future expansion, and assume a long-term software evolution. Most of today’s newest cars are not designed this way outside of perhaps the infotainment unit, which has more capability as the electronic control units (ECUs) in those systems have greater memory and storage and are better equipped for future upgrades. Other than safety systems, the rest of a vehicle’s ECUs were designed to be cost-optimized for the sale.

There’s a paradigm shift taking place in the automotive industry, and car designers and OEMs must now think about what it will take for a vehicle to stay current with technology. How can room be designed in for the expansion of software? Can new code be leveraged that can make use of future vehicle intelligence? If engineers start thinking thais way, they might be able to utilize higher function ECUs and actually reduce the total number of processors. For example, today’s car has 60 to 100 ECUs, but by using super ECUs this number could easily be reduced to around 30; Tesla has already been doing this.

A new approach to maintenance and upgrades

One of the reasons OTA is so popular with car owners who use it is the remarkable convenience. While most vehicle software updates have been limited to bug fixes, recall avoidance, and security patches, the time is coming where more non-mechanical maintenance chores can be done via OTA, avoiding the annoyance of driving to the repair shop, waiting around, and sometimes having to arrange alternate transportation. This is hugely frustrating to consumers who are used to smartphone updates happening wherever they are. But imagine having non-mechanical maintenance and updates performed OTA while the car is in the parking lot during work.

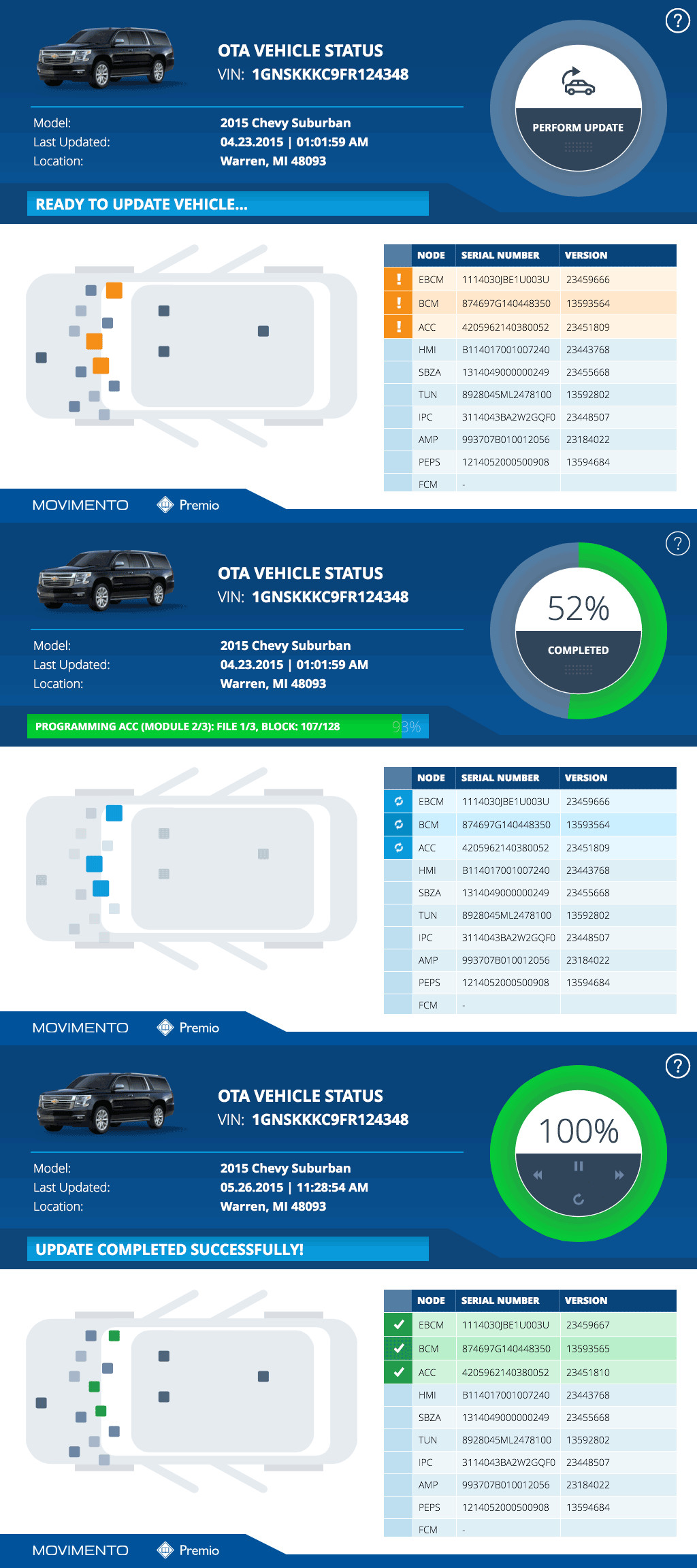

Even today, many consumers would likely pay more for OTA-driven updates that impact their convenience, but this requires seeking out unified OTA solutions that include support for legacy systems, in contrast to proprietary approaches involving brand-specific code frequently seen among manufacturers. Certainly, of most appeal to automotive OEMs and Tier 1 manufacturers is an approach that car software management company Movimento recently brought to the market that encompasses the entire software updating needs of the car as a whole (Figure 1).

|

Another superior OTA feature that isn’t yet commonplace but can be found on the market is bidirectional data gathering within the car. Using bidirectional data gathering, an agent gathers vehicle diagnostics, prognostic, and preventative analytics data, which could be used to not only provide information to third-party companies such as insurance agencies, but could also be used to intelligently determine when software updates to the car can be applied safely and proactively.

New business model: Adding features through OTA

If car owners had a say, they would certainly choose to use OTA for not only updates and non-mechanical maintenance, but other tasks as well given its superior convenience. Taken to the next level, OTA could even provide cars with a new set of capabilities, such as changing vehicle performance. A car owner could go to an OEM and request an increase from 230 to 320 horsepower since that could be accomplished by tuning the performance of the engine and transmission, which could be made achievable through OTA updates while the car owner is on a lunch break.

Car companies can use OTA technology to create new businesses for themselves as well. Consider a consumer who wants a better audio system, selects the update from an online menu, and applies it through an OTA software upgrade. Alas, this concept doesn’t happen today since dealers are the point of contact for car owners rather than OEMs and manufacturers, and the relationship with a buyer is largely over after the initial sale. But imagine an auto company with the foresight to have developed an ecosystem of relationships with independent software vendors (ISVs) such as Spotify or Pandora that provide music for the car. Having designed their vehicle as a software platform for ecosystem partners, relying on them to deliver the necessary software and opening up a new potential revenue stream.

Of course, this concept also requires that vehicles become open systems without the proprietary mindset favored by manufacturers today. The current approach isn’t user centric and doesn’t offer the customer more benefit, which can be seen as leaving significant potential income on the table. In reality, automobiles could be like iPhones, with open-source code that is used by a huge array of suppliers that make aftermarket applications for cars.

In this world, the role of the manufacturer would be as the gatekeeper that controls the repository, much like Apple is with its products today. The manufacturer will make sure that when new apps become part of the overall offering they meet certain quality criteria, privacy, security, and other standards. In this open-source universe, innovation and content creation isn’t limited to one company, but rather is available to the entire market, which represents much more than a single manufacturer could develop.

The ultimate key fob

Another aspect of the software-defined car with major potential is personalization. Today, many newer cars have key fobs containing settings for that user (seat position, steering wheel height, headrest, door mirrors, preprogrammed infotainment system settings, etc.). But if this profile were stored in the cloud, it could not only personalize the owner’s vehicle, but be used for rental cars, friends’ cars, and more. Rather than having the user adapt to the car, the car adapts to the user – clearly a superior way of thinking for companies with a mind toward untapped revenue.

The possibilities of the software-defined car are enormous, but a critical part of having so much information sent via radio signals is obviously security. Personal information, safety systems, and other key data for a vehicle must be protected using secure connectivity, which is achievable today in some OTA products. The most advanced approach uses cybersecurity technology to continually protect the entire vehicle from unauthorized messages, including malware and security breaches of any kind.

A software-defined future

IoT might be a buzzword, but it also makes so much sense that it’s unstoppable. Automation cuts costs and helps create new business opportunities, which can provide the auto industry with an income stream long after the car is initially sold. The mindset of software-dependent industries that earn their profits through an ongoing march of products with new features and functions doesn’t yet exist among automotive corporations, but it inevitably will. The question is whether to get ahead of the curve or be among the stragglers who resist change.

Movimento