Reshaping vehicle insurance with telematics systems

December 01, 2014

Usage-based insurance (UBI) is a hot topic: it delivers tangible benefits to consumers, the insurance industry, and society, but despite the huge pote...

The way motor insurance risks are assessed has stood still for many years – based on static, statistical data like age, gender, car model, etc. Telematics technology allows objective assessments of risk profiles to be based on real-time, dynamic data like mileage, area, time of day, keeping to speed limits, engine RPM, fuel level, and driver behavior. It can also be paired with publicly available data to identify road type and weather conditions.

Insurers benefit from the ability to detect and retain the majority of the lowest risk drivers. On the other hand, drivers, particularly young drivers, can get significant discounts on their premiums. Moreover, careful drivers cause fewer accidents, which is, of course, a big benefit for society at large.

The way ahead

The stats indicate very healthy growth for UBI, with ABI Research expecting a 12x increase by 2019. On the surface, there seems to be a rock-solid business case for both drivers and insurers. There are vocal advocates for smartphone-based UBI, but the insurance industry and regulators – the organizations that matter – have a number of valid concerns: They are highly critical of the reliability and accuracy of data that is delivered: phones can be removed accidentally or run out of battery, users would need to start the UBI app manually, phones could be dropped or become airborne during an impact, and driving behavioral data such as braking, turning, accelerating is likely to be inaccurate and unreliable, among other issues.

A fragmented market also causes uncertainty and low adoption rates. The market comprises a mix of hardware vendors, insurance companies, vehicle manufacturers, and regulatory authorities whose mandated timelines are different in each country. Significant benefits are being realized for telematics systems such as fleet management, usage-based insurance, emergency calls, stolen vehicle recovery, diagnostics, and toll payments. However, these are fixed-point solutions that perform a single function. This indicates the need for open platforms running on robust hardware that will enable the development of consolidated solutions.

The development of an open, global standard is challenging, and needs a fair degree of adoption to be successful. Various government regulations are being proposed, such as the eCall emergency response system in Europe, ERA GLONASS in Russia, and the Denatran anti-theft recovery system in Brazil. However, apart from ERA GLONASS that aggregates location-based services in the basic system, these regulations only address a single vertical issue. As such, they perpetuate market fragmentation.

The in-vehicle network

The in-vehicle network of a connected car has three domains: the physical network and the electronic control units (ECUs), the communications portal at the company that delivers services, and the communications link between the vehicle and the portal. ECU embedded computer systems control one or more of the car's electrical system or subsystems. ECUs exchange data over this network using the controlled area network (CAN) standard. Every CAN packet is broadcast to all the elements on the same bus, which means each node can interpret them.

OBD-II is a standard that provides almost complete engine control and also monitors parts of the chassis, body, and accessory devices, as well as the diagnostic control network of the car. Vehicles have an OBD (onboard diagnostics) connector, an interface to the CAN network, that garages use for reading information when they service vehicles. This interface to the CAN network is also used to obtain relevant vehicular data for insurance services using OBD dongles.

The hardware

Insurance telematics embedded systems are fitted into vehicles as they are made, though right now only by luxury carmakers such as Audi, Cadillac, Daimler-Benz, and BMW. UBI should be seen as a subset of a comprehensive system that includes navigation and in-car entertainment and information. There is also an increasing trend among insurers to employ M2M technologies that reduce losses due to car theft and, in addition to tracking location, devices can disable engines if an unauthorized access has been determined.

So-called "black boxes" provide similar functionality, but they are an after-market product that can be fitted into vehicles after they have been manufactured. They are normally housed in a secure part of the vehicle that is not easy to access.

In the U.S., systems based on OBD dongles have become the preferred option for eight of the top ten personal motor insurers. These robust devices are unobtrusive and, because they have a semi-permanent wired interface to the vehicle's electronic system, they provide the precise driving data that is needed for a UBI policy.

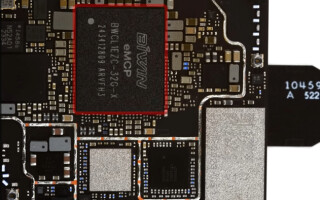

For example, data loggers like the one from DanLaw (Figure 1) have the same form factor as a regular dongle but they provide small, self-installed, cost effective, OBD-connected telematics solutions for monitoring, logging, and transmitting vehicle network message and position data.

The hybrid wireless communication device enables data communication and connectivity through GSM and Bluetooth wireless connections. Optionally it can capture timestamped accelerometer and GPS position information.

Smartphones: Confusion in the market

For insurers, smartphone apps are a tool to collect data to use for risk assessment. Free UBI trials allow smartphone services to be employed as a "teaser" that introduces the concept, allows drivers to see their driving behavior at the end of the trial, and informs them about the potential reduction in their premium if they drive carefully.

Due to concerns by the insurance industry and regulators, the great majority of the insurance industry is only offering premium reductions on dedicated in-vehicle devices like OBD dongles. It is worth noting that drivers can use smartphones in conjunction with a dedicated in-vehicle device in order to get real-time feedback on their driving behaviour. For example, if they are driving too fast a warning could be given about a potential rise in the premium.

End-to-end solutions

End-to-end solutions are needed in order to allow telematics service providers (TSPs) to focus on the applications, which are their core competence. That is the key that will unlock UBI's potential. In turn it will allow hardware vendors to ship aftermarket devices that can be demonstrated almost immediately, thereby accelerating time-to-market. IMETRIK recently announced a solution based on a telematics device that starts gathering information on driving behavior as soon as it is connected to the OBD interface. IMETRIK also manages its own mobile network infrastructure, which enables seamless connectivity to the insurer's back-office infrastructure.

IMETRIK's device provides cellular and positioning modules specifically created for deployment in dongles, where real-estate space is very limited, and enables connectivity to an open platform known as m2mAIR that runs a robust set of value-added services hosted in the cloud.

Creating telematics devices for the insurance industry

Right now the market for UBI is largely untapped, but the number of policies is set to rise to 100 million by 2020. This represents a very attractive opportunity for new entrants – hardware vendors as well as TSPs. Established TSPs are also developing added-value services that capture the demands of the increasingly connected world.

However, new entrants need to be aware that UBI's use of cellular networks means that the devices have to be certified by the mobile network operator before they can be deployed. It's clear that established TSPs have everything they need to operate a service, but in many cases their back-office system would have been designed three or more years ago – a long time in high-tech circles. Issues can arise, such as scaling the solution or increasing the security.

Telit Wireless Solutions www.telit.com